When your client asks which platform will deliver better results for their budget, the answer isn’t about declaring a winner—it’s about understanding two fundamentally different tools for reaching B2B buyers. The choice between Google Ads and LinkedIn Ads shapes everything from cost per lead to sales cycle length, and making the wrong recommendation can waste thousands in ad spend.

Here’s what agencies need to know to make platform recommendations backed by current data and strategic thinking.

The Core Difference Between These Platforms

The fundamental distinction between these platforms isn’t just audience size—it’s about buyer intent and timing.

Google Ads captures demand. With billions of searches happening daily, Google Ads reaches people actively looking for solutions. When someone searches for specific business software or services, they’re expressing intent right now. According to Dreamdata’s 2024 B2B benchmarks analysis, search ads accounted for 37% of B2B web traffic in 2024, making it essential for capturing demand that already exists.

LinkedIn Ads generates demand. You’re reaching professionals based on who they are—job title, company size, industry, seniority—not what they’re currently searching for. With over 1 billion members, LinkedIn provides access to business decision-makers who might be perfect prospects even if they’re not actively searching yet.

This distinction drives costs, conversion patterns, and ultimately which platform deserves client budget allocation.

Which Platform Should You Choose?

Start: What’s Your Monthly Ad Budget?

Under $3,000/month

Limited budget requires focus

→ Google Ads

Better for immediate lead generation with smaller budgets

$3,000 – $8,000/month

Moderate budget allows testing

→ Choose by Sales Cycle

Under 3 months = Google

Over 6 months = LinkedIn

$8,000+/month

Sufficient for multi-platform

→ Both Platforms

LinkedIn for awareness, Google for conversion

Key Decision Factors Beyond Budget:

Deal Value

$10k+ favors LinkedIn

Buying Committee

Multiple stakeholders = LinkedIn

Search Volume

High intent searches = Google

Market Education

New categories = LinkedIn

Situations Where Google Ads Makes Strategic Sense

Think about your clients who need results this quarter, not next year. Google shines when prospects already know they have a problem and they’re actively looking for solutions.

High-Intent Lead Capture

Google Ads excels when prospects are actively searching. The average conversion rate across Google Ads reached 7.52% in 2025, representing a 6.84% increase year-over-year.

This improvement partially offsets rising costs. It demonstrates Google’s effectiveness at converting intent-driven traffic.

What You’ll Actually Pay for Google Ads

The numbers tell a clear story. Costs are rising but the rate of increase has slowed significantly compared to previous years.

| Metric | 2024 | 2025 | Change |

|---|---|---|---|

| Average Cost Per Lead | $66.69 | $70.11 | +5.13% |

| Average Conversion Rate | 7.04% | 7.52% | +6.84% |

| Industries with Better CVR | N/A | 65% | New data |

For B2B specifically, CPCs often exceed $8.86, reflecting higher customer lifetime value in B2B transactions. The good news? 65% of industries experienced better conversion rates in 2025, meaning improved performance helps offset cost increases.

Non-branded search ads command an average CPC of €21.10 with a return on ad spend of 78%. These campaigns require substantial budget. Non-branded Google Ads represent 39% of B2B ad budgets but they deliver consistent lead volume.

Scale Without Ceiling Effects

Unlike LinkedIn’s finite professional network, Google’s reach is essentially unlimited.

For clients needing volume and capable of handling high lead flow, Google won’t hit audience exhaustion. You can continue scaling spend as long as ROI remains positive.

Does your client have the sales team capacity to handle a sudden influx of leads? If yes, Google’s unlimited scale becomes a competitive advantage.

Situations Where LinkedIn Ads Becomes Essential

LinkedIn costs more upfront but the ROI data tells a different story. For agencies managing high-value B2B clients, LinkedIn often delivers returns that justify the premium pricing.

Superior B2B Return on Investment

LinkedIn Ads achieved 113% return on ad spend in 2025, the highest of all major platforms. This outperforms Google Search at 78% and Meta at 29%. This makes LinkedIn the only major platform delivering positive returns for B2B advertisers.

2025 B2B Platform ROAS

Return on Ad Spend by Platform

LinkedIn Ads

113%

$1.13 return per $1

✓ Only platform with positive ROI

Google Search

High-intent capture platform

Meta Ads

Limited B2B effectiveness

What This Means:

LinkedIn delivers $1.13 for every $1 spent, while Google returns $0.78 and Meta only $0.29. For B2B campaigns prioritizing ROI over volume, LinkedIn’s premium pricing is justified by superior returns.

Compare these ROAS numbers across platforms:

- LinkedIn Ads: 113% ROAS

- Google Search: 78% ROAS

- Meta Ads: 29% ROAS

In 2024, LinkedIn Ads’ share of total B2B ad budgets grew from 31% in the first half to 39% by year-end. This positions it as the largest single advertising platform by spend when Google’s networks are examined separately.

The Long B2B Buying Process

The average B2B customer journey takes 211 days and requires 76 touches before purchase. It involves 6.8 buyer stakeholders across 3.7 channels. Large companies’ customer journeys are 49% longer than standard.

When you’re dealing with purchase decisions that stretch over seven months and involve almost seven people, your ad platform needs to support long-term nurturing, not just quick conversions.

LinkedIn’s role concentrates in early stages:

- 29% of MQLs influenced by LinkedIn

- 36% of SQLs influenced by LinkedIn

- 35% of new business deals influenced by LinkedIn

This makes it essential for long-cycle B2B sales where multiple stakeholders need education before making purchase decisions.

What You’ll Actually Pay for LinkedIn Ads

LinkedIn’s average CPC ranges from $5.58 to $10, with CPM between $33.80 and $55. CPC averages $10.48 in Q1 and rises to $15.72 in Q3 as competition increases.

LinkedIn’s CPC pricing sits between $2.00 and $3.00 per click on average according to WebFX’s survey of U.S.-based marketing professionals. B2B campaigns targeting senior decision-makers typically pay higher rates due to audience value and competition.

Why Targeting Precision Justifies Premium Prices

LinkedIn has the lowest cost per company influenced at €154. This supports its effectiveness for account-based marketing strategies.

The platform’s ability to target by job title, seniority, company size, and industry puts ad spend directly in front of decision-makers. Not entry-level employees without budget authority.

Think about the difference between reaching “anyone interested in marketing software” versus “VP of Marketing at 500-1000 person SaaS companies in North America.” That precision changes everything about lead quality.

Platform-Specific Performance Metrics

The numbers matter because they tell you what’s realistic to promise your clients. Here’s what current data shows about actual performance on each platform.

Platform Performance Comparison 2025

Key metrics to inform your platform decision

Key Takeaway: Google wins on volume metrics (CTR, conversion rate, cost per lead), while LinkedIn wins on quality metrics (ROAS, targeting precision). Choose based on whether you need leads or revenue.

Google Ads Performance Benchmarks

B2B tech companies experienced an average conversion rate of 1.42% in 2024 for paid search. That’s 2.3 points lower than the 8-year average.

This suggests potential fatigue from gated content strategies. Are your clients still gating everything behind forms, or have they adapted?

For B2B SaaS, a good CTR is 3.2% for search campaigns and 0.9% for display campaigns. Display remarketing campaigns achieved 2.45% conversion rates. That’s substantially higher than the network average of 0.80%.

Funnel conversion metrics for Google Ads:

| Stage | Conversion Rate | What This Means |

|---|---|---|

| MQL to SQL | 25.79% | About 1 in 4 marketing qualified leads becomes sales qualified |

| SQL to Closed-Won | 16.30% | About 1 in 6 sales qualified leads actually closes |

| Revenue ROI | 1.38x | Most companies barely break even on Google alone |

Average revenue ROI for Google Ads reached 1.38 in Q1 2024, up from 1.13 in 2022. Most companies barely break even on Google Ads investments alone. This is why multi-platform strategies matter so much.

LinkedIn Ads Performance Benchmarks

LinkedIn ad CTR averages between 0.44% and 0.65% globally. Single image ads get 0.56%, video content gets 0.44%, and carousel ads get 0.40%.

Timing matters on LinkedIn. Q3 delivers the highest engagement with an average CTR of 0.96%, with September reaching 1.05%.

Should you be shifting more budget to Q2 and Q3 based on these patterns? Probably, but test it with your specific client accounts first.

LinkedIn performance by quarter:

- Q1: Lowest CPC at $10.48, solid for testing

- Q2: Best cost-effective MQLs, 2.53x spend-to-pipeline ROI

- Q3: Highest engagement (0.96% CTR), 6.01x pipeline ROI, but CPC jumps to $15.72

- Q4: Revenue conversion peak from earlier pipeline

75% of advertisers using LinkedIn Ads have integrated LinkedIn’s Conversions API. CAPI users achieve 20% lower cost per action and 31% more attributed conversions compared to standard tracking.

If your clients aren’t using CAPI yet, that’s a quick win you can implement.

Thought Leader Ads achieve CTR up to 2.3x higher than standard single-image ads. This demonstrates the value of authentic, person-to-person content over corporate messaging.

The Multi-Platform Strategy

Most successful B2B campaigns don’t choose one platform—they orchestrate both strategically. But how do you actually structure this for clients?

Sequential Funnel Approach

Use LinkedIn for awareness and consideration at the top and middle of the funnel. Target decision-makers with educational content and thought leadership.

Then deploy Google Ads for bottom-funnel conversion. Capture prospects when they actively search for solutions.

This approach recognizes that the MQL to SQL stage takes 107 days on average, compared to 62 days from SQL to closed deal. Marketing teams must nurture leads toward buying readiness, not just generate initial interest.

The longest part of the sales cycle happens before sales even gets involved. This is why your platform mix matters so much for early-stage influence.

How to Split Budget Between Platforms

B2B marketers allocated 39% to LinkedIn, 37% to Google Search, and 8% to Meta by late 2024. This distribution reflects LinkedIn’s growing importance for B2B lead generation combined with Google’s continued strength in high-intent capture.

For clients with $10,000+ monthly ad budgets, consider allocating based on sales cycle length. A $5,000 software purchase happens faster than a $500,000 enterprise implementation, so your budget split should reflect that reality.

Recommended Budget Split by Sales Cycle

Based on 2024 B2B marketing allocation data

Short Sales Cycle (0-3 months)

Quick conversions

Emphasize Google’s intent capture. Prospects move quickly from awareness to decision, making search ads highly effective for closing ready buyers.

Medium Sales Cycle (3-6 months)

Balanced approach

Equal split works best. LinkedIn builds awareness among target accounts while Google captures them when they enter active evaluation mode.

Long Sales Cycle (6+ months)

Extended nurture

Prioritize LinkedIn for sustained influence. With 211-day average B2B journeys and 6.8 stakeholders, LinkedIn’s targeting reaches decision-makers throughout the extended process.

Industry Standard (Late 2024)

39%

Google Search

37%

Meta

8%

Critical Implementation Considerations

You can have the perfect platform mix and still fail if you don’t handle these implementation details correctly. Most agencies get platform selection right but stumble on execution.

Attribution Complexity

According to Gartner’s Q1 2025 survey, 68% of B2B marketers cite correct attribution as one of their biggest challenges.

LinkedIn typically influences early stages while Google drives later conversions. This makes multi-touch attribution essential.

When LinkedIn engagement data is included in revenue attribution modeling, there’s a 7.7x increase in revenue attribution accuracy. Without proper attribution, agencies risk undervaluing LinkedIn’s contribution to pipeline.

Are you giving LinkedIn credit for the awareness it builds that eventually converts through Google search?

Minimum Budget Requirements

For cold audiences, allocate at least $3,000 per month and plan for a 3-4 month testing phase to evaluate performance.

Smaller budgets spread too thin across campaigns won’t generate sufficient data for optimization decisions.

Platform minimum budgets:

- Google Ads: $1,500-2,000 monthly for testing

- LinkedIn Ads: $3,000-5,000 monthly for meaningful results ($10 daily minimum per campaign)

- Combined approach: $8,000+ monthly to properly test both

If your client can’t commit to at least three months at these levels, you’re better off focusing on one platform than splitting budget ineffectively.

Conversion Tracking Requirements

64% of LinkedIn CAPI users optimize toward pipeline conversions and revenue rather than top-funnel metrics. Feed offline conversion data back to platforms for improved campaign optimization rather than relying solely on click or form-fill metrics.

What happens after someone fills out your lead form? If you’re not sending that data back to the ad platforms, you’re flying blind on actual business outcomes.

How to Make Data-Driven Recommendations

Your clients hired you to make these decisions, not to give them homework. Here’s how to structure your platform recommendations based on their specific situation.

When to Recommend Google Ads as Primary

Does your client’s product solve a problem people already know they have? If prospects are googling “best [solution category]” or “[competitor] alternative,” Google captures that existing demand.

Google makes sense when:

- Sales cycles run under 3 months

- Solution categories have high search volume

- Clients need immediate lead generation

- Budget constraints sit under $3,000 monthly

- Mixed B2B/B2C audiences need to be reached

When to Recommend LinkedIn Ads as Primary

Think about whether your client’s prospects know they have a problem yet. If you’re selling something innovative that requires market education, LinkedIn builds awareness before people even know what to search for on Google.

LinkedIn makes sense when:

- Average deal values exceed $10,000

- Sales cycles exceed 6 months

- Multiple stakeholders sit in buying committees

- Highly specific target audiences in niche industries or senior roles

- New product categories require education

- Budget capacity supports $5,000+ monthly investment

When to Recommend Multi-Platform

Most B2B companies with mature sales processes end up here. You need LinkedIn to build awareness among target accounts and Google to capture them when they’re ready to evaluate options.

Multi-platform makes sense when:

- Budget exceeds $8,000 monthly combined

- Sales cycles span 3-6 months

- Both demand generation and capture are needed

- Attribution shows multi-channel influence patterns

The Agency Advantage

Your value as an agency comes from knowing which platform strategy serves each client’s specific situation. Don’t lead with features—lead with business outcomes.

When presenting recommendations, show the math. If LinkedIn costs $400 per lead versus Google’s $150, but LinkedIn delivers 113% ROAS compared to Google’s 78%, the more expensive lead becomes cheaper per dollar of revenue generated.

Walk clients through the full calculation from lead cost to closed deal value.

With B2B processes averaging 211 days and 76 touches, clients need patience and sustained investment. Set realistic timeline expectations—meaningful results take quarters, not weeks.

If your client expects ROI in 30 days, reset expectations now or decline the engagement.

Platform performance changes constantly. Cost per lead increases moderated to 5% in 2025 from 25% the previous year, suggesting some market stabilization, but competition continues intensifying.

Build regular performance reviews into client relationships and stay willing to adjust recommendations as data dictates. The Google Ads versus LinkedIn Ads question doesn’t have a universal answer—it has the right answer for each client based on their goals, market position, and sales process.

Google Ads vs LinkedIn Ads FAQ

Quick answers to your most common B2B advertising questions

LinkedIn is better for B2B in most cases. It delivers 113% ROI compared to Google’s 78%, making it the only platform with positive returns for B2B advertisers. LinkedIn lets you target decision-makers by job title, company size, and industry—reaching the exact people who make purchasing decisions.

However, Google works better if your prospects are already searching for solutions and you need leads quickly. Use Google when your sales cycle is under 3 months. Use LinkedIn when you need to reach specific executives who aren’t actively searching yet.

Google captures existing demand; LinkedIn creates new demand. When someone searches “project management software,” they’re actively looking for a solution right now. Google Ads shows your product to people already in buying mode.

LinkedIn shows your ads to specific professionals based on their job title, company, and industry—even if they’re not searching for anything. It’s the difference between catching people who are shopping versus introducing your solution to people who should be your customers but don’t know you exist yet.

Google Ads is easier to start with. It requires less upfront budget ($1,500-2,000 monthly vs LinkedIn’s $3,000-5,000), has simpler campaign setup, and delivers faster results. You’ll see leads coming in within days once campaigns launch.

LinkedIn requires more strategic planning, higher minimum budgets, and typically takes 3-4 months to optimize properly. Start with Google if you’re new to paid advertising or have limited budget. Move to LinkedIn once you understand your customer acquisition costs and can invest in longer-term strategies.

Yes, and most successful B2B companies do. Use LinkedIn to build awareness with decision-makers at the top of your funnel, then use Google to capture those same people when they start actively searching for solutions weeks or months later.

You’ll need at least $8,000 monthly budget to run both effectively. Split your budget based on sales cycle: 65% Google + 35% LinkedIn for quick sales (under 3 months), or 35% Google + 65% LinkedIn for longer enterprise sales (over 6 months).

Ask yourself three questions: (1) Is my average deal worth more than $10,000? (2) Does my sales cycle take longer than 6 months? (3) Do multiple executives need to approve purchases? If you answered yes to two or more, choose LinkedIn.

Choose Google if people are already searching for your solution category, you need leads this month (not next quarter), or your budget is under $3,000 monthly. Choose LinkedIn if you’re selling to specific roles at specific company sizes, deals require multiple stakeholders, or your solution needs market education.

For B2B, expect to pay $70 per lead on average. Cost per click typically ranges from $2-3 for general B2B, but can exceed $8-10 for competitive industries like software and finance. You’ll need a minimum monthly budget of $1,500-2,000 to generate enough data for meaningful optimization.

Non-branded searches (generic terms like “CRM software” rather than competitor names) cost more—around $21 per click—but deliver consistent volume. Budget more if you’re in competitive spaces or targeting high-value keywords.

LinkedIn costs $150-400 per lead, with cost per click ranging from $5-10. You’ll need a minimum $3,000 monthly budget, and LinkedIn enforces a $10 daily minimum per campaign. Costs spike in Q3 when competition peaks—CPC can jump to $15 during high-demand months.

While LinkedIn costs 2-5x more per lead than Google, it delivers 113% ROI versus Google’s 78%. The higher upfront cost is justified by reaching actual decision-makers with budget authority rather than just anyone clicking your ad.

You’re paying for precise targeting that Google can’t match. LinkedIn lets you target “VP of Sales at 500-1000 person SaaS companies in North America.” Google can only target “anyone searching for sales software.” That precision means you’re not wasting money on job seekers, students, or junior employees without purchasing power.

Think of it this way: would you rather pay $70 for a lead that might be a qualified buyer, or $200 for a lead you know is a decision-maker with budget authority? LinkedIn’s higher cost reflects reaching the exact people who can say “yes” to your proposal.

Start with $8,000-10,000 monthly split between both platforms. Allocate $3,000-4,000 to Google and $5,000-6,000 to LinkedIn, or adjust based on your sales cycle length. Commit to testing for at least 3-4 months before making decisions—shorter tests don’t capture seasonal variations or full customer journeys.

If you can’t commit $8,000+ monthly, focus on one platform. Use Google if you need results this quarter. Use LinkedIn if you’re building pipeline for next quarter and beyond.

Yes—budget for landing pages, creative assets, and conversion tracking setup. You’ll need dedicated landing pages optimized for each platform (expect $2,000-5,000 for professional design). LinkedIn requires high-quality visuals and video (budget $500-2,000 per creative set). Both platforms need proper conversion tracking, which may require developer help.

Also factor in agency fees if you’re outsourcing management (typically 15-20% of ad spend) or software costs for analytics, call tracking, and attribution tools ($200-1,000 monthly). The ad spend is just one part of your total investment.

Google gets significantly higher click rates at 3.2% vs LinkedIn’s 0.44-0.65%. People actively searching on Google are more likely to click ads because they’re looking for solutions right now. LinkedIn users are scrolling their feed and not in “shopping mode,” so fewer click through.

However, lower click rates on LinkedIn don’t mean worse performance. LinkedIn’s clicks come from targeted decision-makers, while Google’s clicks include researchers, students, and competitors. Focus on conversion to revenue, not just clicks.

Google converts better at 7.52% vs LinkedIn’s 0.44-0.65%. Google’s higher conversion rate reflects search intent—people clicking your Google ad are actively looking for solutions and ready to take action. LinkedIn users need more nurturing because they weren’t necessarily looking for your product when they saw your ad.

But here’s what matters more: LinkedIn turns 113% of your ad spend into revenue versus Google’s 78%. So while Google converts more clicks into leads, LinkedIn converts more leads into paying customers at higher deal values.

Google delivers leads within days; LinkedIn takes 3-4 months to optimize. You’ll see Google traffic and leads immediately once campaigns go live, though it takes 30-60 days to optimize for lower costs. LinkedIn requires longer because you’re building awareness with people who weren’t actively shopping.

For actual closed deals, expect 3-6 months from either platform depending on your sales cycle. The average B2B journey takes 211 days and 76 touchpoints, so “results” means different things at different stages. Set expectations for lead generation (weeks), pipeline development (months), and closed revenue (quarters).

LinkedIn delivers higher-quality leads for B2B. You’re reaching people by job title and seniority, so you know your leads are actual decision-makers. Google leads include anyone searching your keywords—that could be competitors researching you, students doing homework, or junior employees without budget authority.

Track lead quality by measuring SQL conversion rate and average deal size, not just lead volume. If Google gives you 100 leads at $70 each but only 10 become sales opportunities, while LinkedIn gives you 30 leads at $200 each with 15 becoming opportunities, LinkedIn wins on quality despite higher cost per lead.

With Google, yes. With LinkedIn, no. Google works with budgets as low as $1,500 monthly and can generate leads within days. Start with tightly focused keyword campaigns targeting your highest-intent searches to maximize limited budgets.

LinkedIn requires $3,000+ monthly and 3-4 months of optimization. Small budgets on LinkedIn spread too thin—you won’t generate enough impressions or clicks to gather meaningful data. If your budget is under $3,000, stick with Google until you can properly fund LinkedIn campaigns.

Track metrics that connect to revenue, not vanity metrics. Essential metrics: cost per qualified lead (not just any lead), MQL to SQL conversion rate, SQL to closed-won rate, average deal size by source, and customer acquisition cost. These show whether ads are generating profitable business.

Avoid obsessing over click-through rates, impressions, or total leads without context. A campaign generating 50 leads at $100 each with 20% becoming customers beats one generating 200 leads at $50 each with 5% becoming customers. Track the full funnel to revenue.

No—they serve different stages of the buyer journey. LinkedIn might show “higher cost per lead” but influence 35% of deals that eventually close through Google search. When you include LinkedIn engagement in attribution modeling, revenue attribution accuracy increases 7.7x. Pausing LinkedIn means losing the awareness that feeds your Google conversions.

Instead of pausing, adjust budget allocation. If one platform clearly outperforms, shift 60-70% of budget there while keeping the other active. Multi-touch attribution tools help you see the real impact of each platform across the full customer journey.

Implement conversion APIs and multi-touch attribution. Set up LinkedIn’s Conversions API (CAPI)—it reduces cost per action by 20% and increases attributed conversions by 31%. Feed offline conversion data (closed deals, not just form fills) back to both platforms so they optimize toward revenue, not just leads.

Use UTM parameters consistently across all campaigns to track the full journey. Integrate both platforms with your CRM so you can see which platform influenced which deals. Without proper tracking, you’ll make budget decisions based on incomplete data and likely undervalue the platform doing early-stage awareness work.

Mistake 1: Using the same landing pages for both platforms. Google traffic is hot—they’re ready to evaluate. Use direct, product-focused landing pages. LinkedIn traffic is cold—they weren’t shopping. Use educational content and softer calls-to-action like “Get the Guide” rather than “Request Demo.”

Mistake 2: Judging success too quickly. Giving LinkedIn only 30 days or Google only a few hundred dollars isn’t enough data. Test for at least 3 months at proper budget levels. Mistake 3: Optimizing for form fills instead of revenue. Track which leads actually become customers, then optimize toward those outcomes, not just lead volume.

Yes—small companies should start with Google; larger ones need LinkedIn. If you’re selling to SMBs with quick decision-making and lower deal values, Google’s volume and speed work better. Small business owners actively search for solutions and decide quickly.

If you’re targeting enterprise companies with complex buying committees, LinkedIn becomes essential. Large companies have 6.8 stakeholders involved in B2B purchases, and you need to reach multiple decision-makers over extended periods. LinkedIn’s targeting lets you systematically reach everyone involved in the buying decision.

Google: SaaS, professional services, agencies, education, and healthcare. Industries where people actively search for solutions when they need them. If prospects google “best [solution type]” or “[competitor] alternative” regularly, Google works well.

LinkedIn: Enterprise software, consulting, recruiting, financial services, and manufacturing. Industries selling to specific roles at specific company sizes with long sales cycles. If your ideal customer is “Director of IT at manufacturing companies with 200-500 employees,” LinkedIn’s targeting is unmatched.

Hire an agency if you’re spending $10,000+ monthly on ads. Agencies typically charge 15-20% of ad spend but provide expertise that improves performance by 30-50%. They’ve already made the expensive mistakes with other clients’ budgets, know platform-specific best practices, and stay current on constant algorithm changes.

Manage in-house if your monthly spend is under $5,000, you have dedicated marketing staff, and can invest time learning both platforms. Use agencies for setup and initial optimization, then bring it in-house once campaigns are profitable. Hybrid approaches—agency for strategy, in-house for execution—work well for many companies.

Weekly for optimization, monthly for strategy adjustments. Check performance weekly to pause underperforming ads, adjust bids, and identify technical issues. Make strategic changes (budget reallocation, new campaigns, audience adjustments) monthly after you have enough data to spot meaningful trends.

Avoid making changes too frequently—algorithms need 2-3 weeks to stabilize after major changes. If you adjust targeting Monday, shift budgets Wednesday, and change bids Friday, you’ll never get clean data. Let campaigns run long enough to gather statistically significant results before making decisions.

Yes, but you’ll likely plateau faster. Companies using only Google eventually saturate their high-intent keywords and face rising costs. Companies using only LinkedIn struggle to capture prospects who become ready to buy and start searching. Single-platform strategies work until you need to scale beyond your initial success.

Most B2B companies start with one platform, prove ROI, then expand to the second. Start with whichever matches your current sales cycle and budget, optimize it to profitability, then add the second platform to reach different parts of the customer journey. This staged approach reduces risk while building toward a complete strategy.

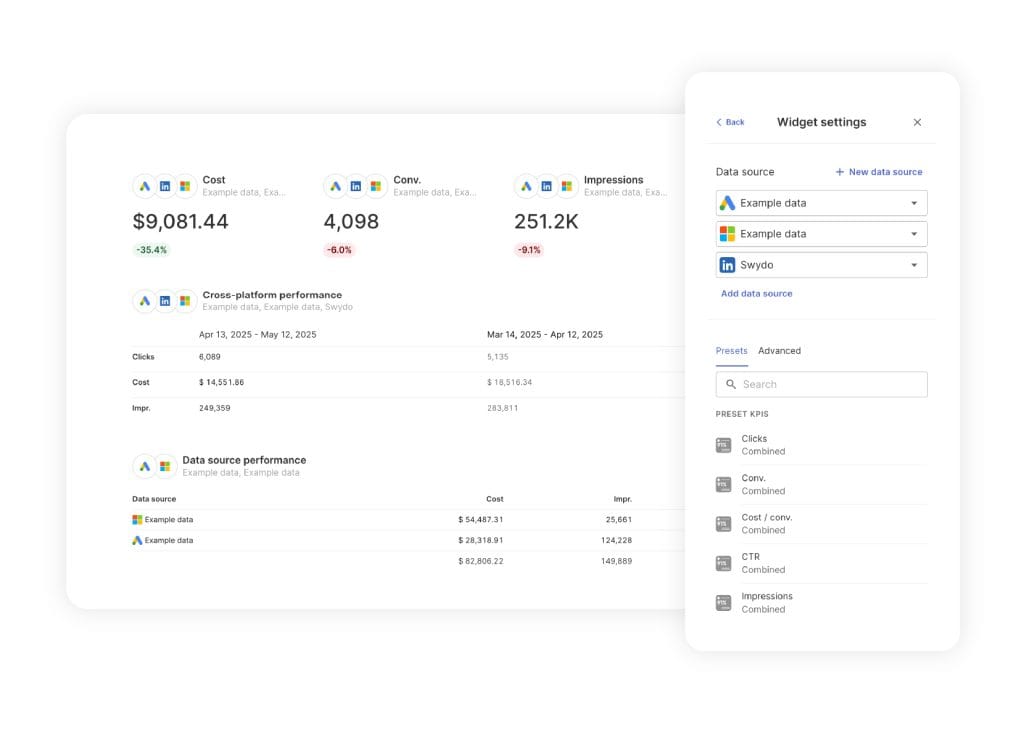

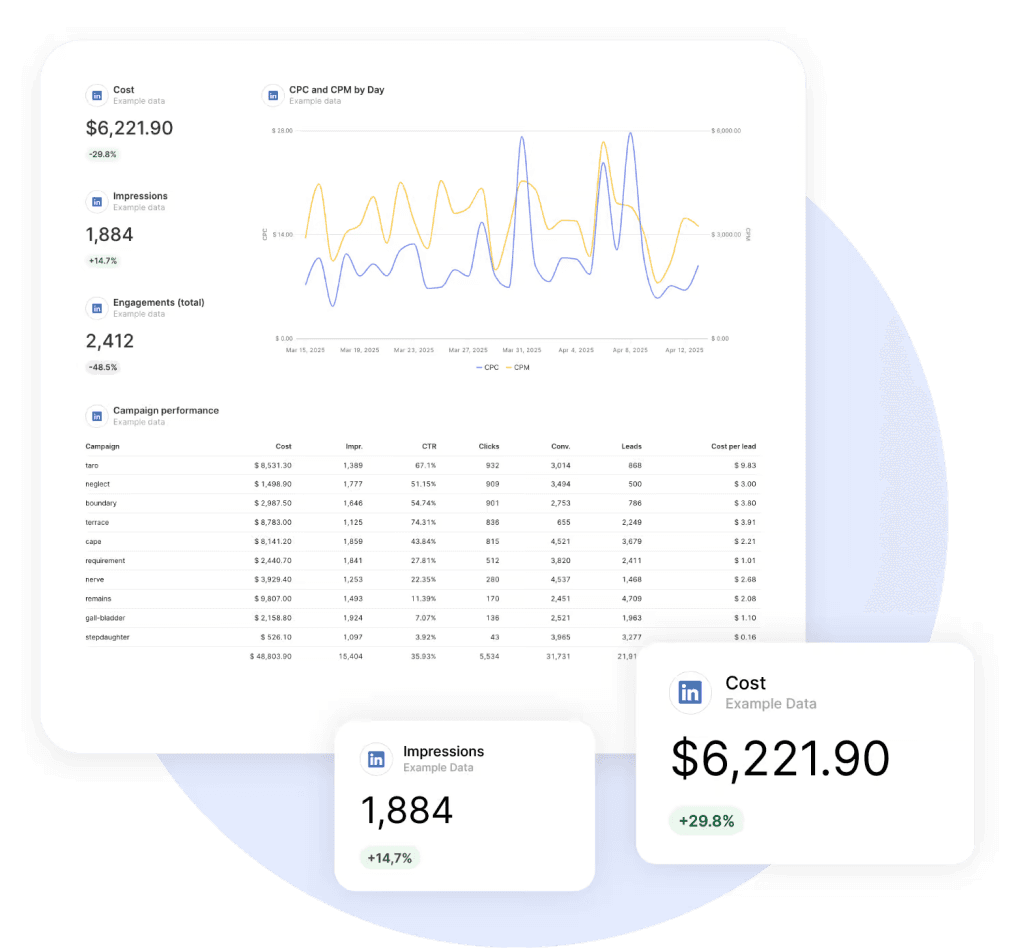

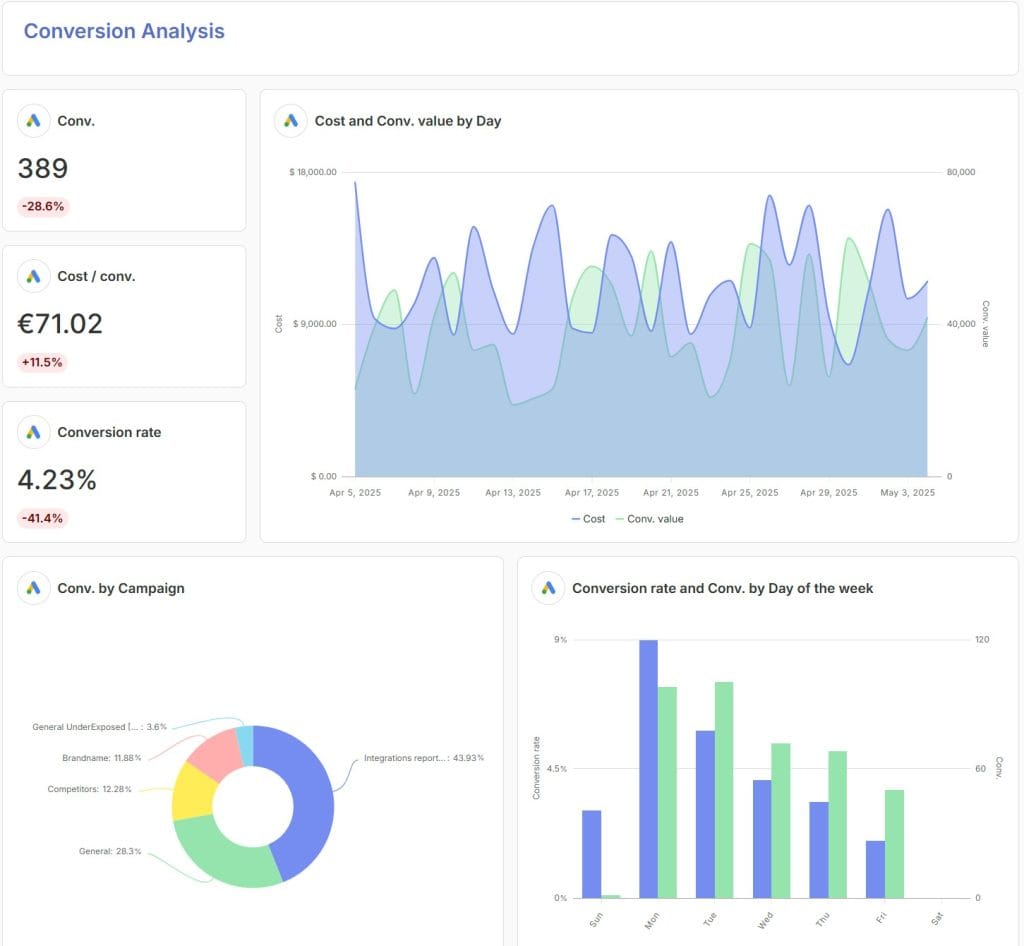

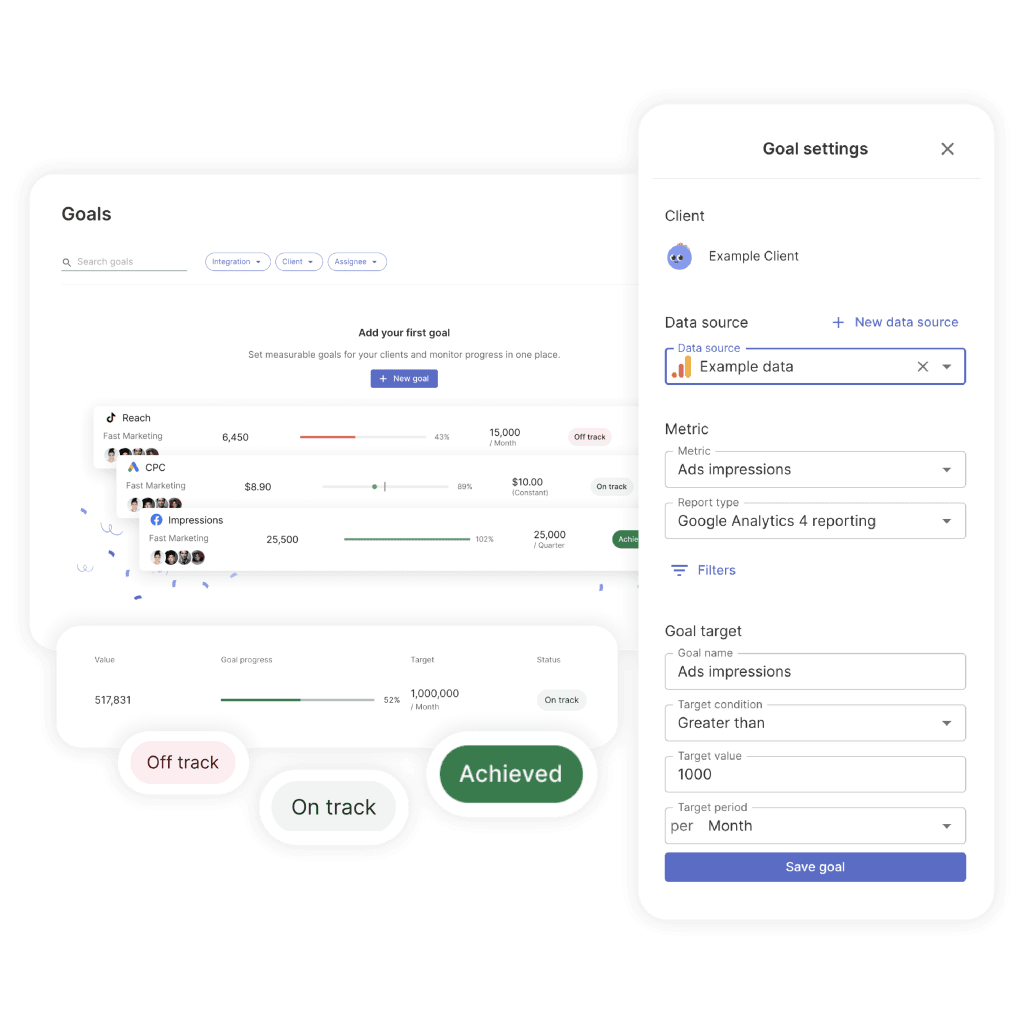

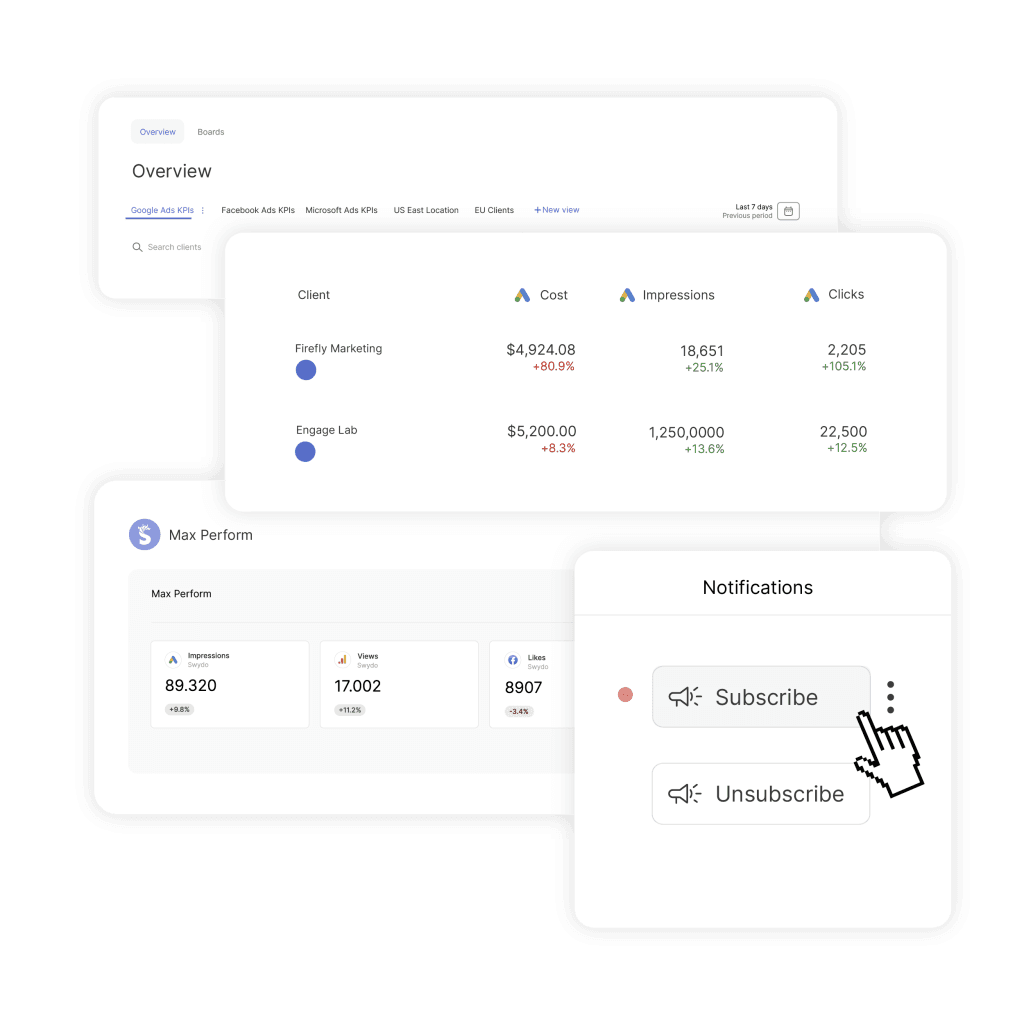

Show clients exactly which platform drives their best results with unified reporting.

Start Your Free Trial Today- The Core Difference Between These Platforms

- Situations Where Google Ads Makes Strategic Sense

- Situations Where LinkedIn Ads Becomes Essential

- Platform-Specific Performance Metrics

- The Multi-Platform Strategy

- Critical Implementation Considerations

- How to Make Data-Driven Recommendations

- The Agency Advantage

- Google Ads vs LinkedIn Ads FAQ